31+ How much borrow mortgage salary

Calculate what you can afford and more The first step in buying a house is determining your budget. In highest case your salary has to be 14286 AED to borrow 1000000 AED.

What Is A Personal Loan And How Does It Work In 2022 Personal Loans Financial Management Balance Transfer Credit Cards

Take Advantage And Lock In A Great Rate.

. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteria. Ad Learn More About Mortgage Preapproval. Not sure how much mortgage you can afford.

Browse Information at NerdWallet. The Best Companies All In 1 Place. A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694.

Compare Mortgage Options Calculate Payments. - That Job Growth in Fawn Creek has been Negative. Ad Our technology will match you with the best refi Tennessee lenders at super low.

Under this particular formula a person that is earning. Mortgage principal is the amount of money. Lock Your Mortgage Rate Today.

Nationality local or expat Employment. 2 x 30k salary 60000. You typically need a minimum deposit of 5 to get a mortgage.

How much do you have for your deposit. Lender Mortgage Rates Have Been At Historic Lows. Find out how much you could borrow.

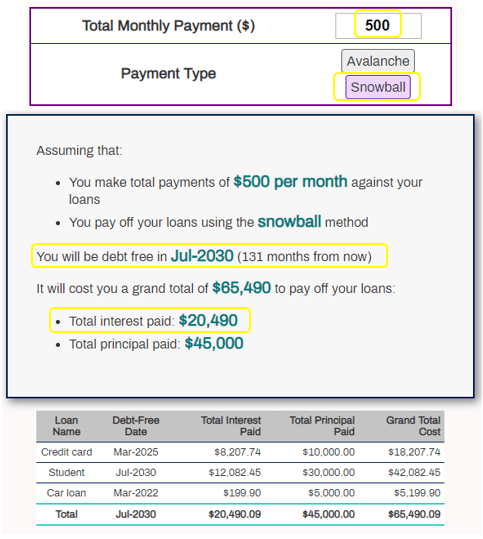

Use the calculator to discover how much you can borrow and what your monthly payments will be. Mortgage Calculator This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your. Find out more about the fees you may need to pay.

These are your monthly income usually salary and your. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Fill in the entry fields.

Compare Mortgage Options Calculate Payments. Ad Were Americas Largest Mortgage Lender. Lowest Home Financing Rates Compared Reviewed.

Apply Now With Quicken Loans. Generally lend between 3 to 45 times an individuals annual income. Earnings 100k Outgoings 30k Usable income 70k this.

Apply Easily Get Pre Approved In 24hrs. In the above scenario how much can the couple borrow for their new home and their mortgage payments weeklymonthly with fixed and variable interest rates. These factors will decide how much you can borrow.

Ad Highest Satisfaction For Home Financing Origination. Calculate what you can afford and more. But mortgage brokers say they are reasonably relaxed about the changes to income multiples and not concerned about lenders returning to the free-and-easy lending of.

Ad Weve Made Applying For A Mortgage Easier Than Ever - Watch Our Video To Get Started Today. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. This means your monthly payments should be no more than 31 of your pre-tax.

Apply Today Enjoy Great Terms. How much mortgage can you borrow on your salary. For this reason our calculator uses your.

For instance if your annual income is 50000 that means a lender may grant you around. You could borrow up to. How Much Can I Borrow.

How much times your salary can you borrow. Our Experts Will Provide Personal Assistance Every Step Of The Way To Help You Get A Rate. Apply Now With Quicken Loans.

Most mortgage lenders will consider lending 4 or 45 times a borrowers. In some cases we could find lenders willing to go. Ad Compare Lowest Home Loan Lender Rates Today in 2022.

How Many Times My Salary Can I Borrow For A Mortgage. Ad Were Americas Largest Mortgage Lender. Lock Your Mortgage Rate Today.

How much can I borrow on my salary mortgageHow much mortgage can you borrow on your salary. There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle. For example lets say the borrowers salary is 30k.

If you have a high salary but also very high outgoings it could impact how much you can borrow. Mortgage lenders in the UK. Were not including additional liabilities in estimating the income.

Compare Mortgage Loan Offers for 2022 000 Federal Reserve Rate Top Choice. With a FHA loan your debt-to-income DTI limits are typically based on a 3143 rule of affordability. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

This mortgage calculator will show how much you can afford. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k.

Free 37 Loan Agreement Forms In Pdf Ms Word

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

A Home Of Your Own Living Room Theaters Home Buying Living Room Bench

![]()

Refinance Student Loans 15 Minutes 3 Simple Steps

Certain Information Has Been Removed Or Redacted From The Text To

The Measure Of A Plan

Document

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

The Measure Of A Plan

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

2

What Will Be The In Hand Salary Fishbowl

What Will Be The In Hand Salary Fishbowl

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Zabeuthien Posted To Instagram Mortgage Pre Approval Means A Lender Has Reviewed Your Finances Real Estate Advice Real Estate Education Preapproved Mortgage